Top Suggestions For Choosing Crypto Backtesting Platforms

What Are The Most Important Things To Know About Rsi DivergenceDefinition: RSI diversence is a technical analytical tool that compares the price change of an asset with the direction in which it is relative strength (RSI).

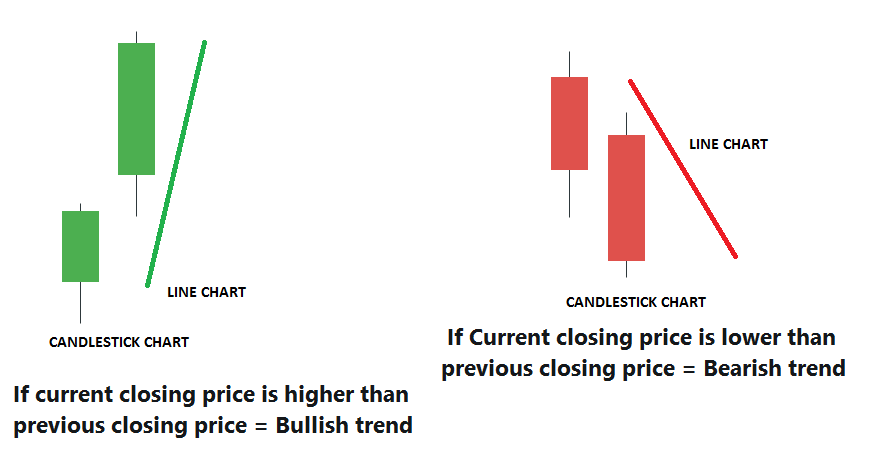

Signal Positive RSI divergence is seen as an indicator of bullishness, while a negative RSI divergence is regarded as bearish.

Trend Reversal: RSI Divergence can signal a trend reversal.

Confirmation RSI divergence should be utilized as a confirmation tool when used in conjunction with other methods of analysis.

Timeframe: RSI divergence is possible to be examined over various timespans in order to get various insights.

Overbought/Oversold RSI Values above 70 indicate excessively high conditions. Values lower than 30 indicate that there are oversold conditions.

Interpretation: In order to interpret RSI divergence properly, you need to consider other technical and fundamental factors. Follow the top rated trading platform for more recommendations including RSI divergence, trading platform cryptocurrency, trading platforms, forex backtester, automated cryptocurrency trading, best forex trading platform, software for automated trading, best forex trading platform, position sizing calculator, forex trading and more.

What Is The Difference Of Regular Divergence And Concealed Divergence

Regular Divergence is when an asset's value makes an upper or lower low while its RSI makes an upper or lower low. It could signal the possibility of a trend reversal. But, it's crucial to consider other factors, both fundamental and technical. It is considered a weaker signal than regular divergence, but it can still indicate an upcoming trend reverse.

Considerations on technical aspects:

Trend lines and support/resistance indexes

Volume levels

Moving averages

Other technical indicators and oscillators

It is vital to be aware of the followingpoints:

Economic data released

Details specific to your company

Market sentiment and sentiment indicators

Market impact and global events

It's important to take a look at fundamental and technical aspects prior to making investment decisions basing them on RSI divergence signals. Read the top rated forex tester for more recommendations including automated trading platform, cryptocurrency trading bot, software for automated trading, software for automated trading, automated forex trading, trading platforms, stop loss, RSI divergence, trading platform crypto, automated trading software and more.

What Are Back-Testing Trading Strategies For Trading Crypto

Backtesting crypto trading strategies is the process of simulating the execution of a trading plan using historic data. This lets you assess the possibility of profit. The following are some steps in backtesting crypto trading strategies:Historical Data: Obtain a historical data set for the crypto asset being traded, including prices, volume, and other relevant market data.

Trading Strategy: Define the trading strategy being tested that includes entry and exit rules, position sizing, and the rules for managing risk.

Simulation Software: Make use of software to simulate the application of the trading strategy using the historical data. This lets you see how the strategy might have performed in the past.

Metrics: Use metrics to evaluate the performance of the strategy, such as profitability Sharpe, drawdown or other relevant measures.

Optimization: Modify the strategy parameters and repeat the simulation to optimize the strategy's performance.

Validation: Evaluate the strategy's effectiveness using out-of-sample data in order to ensure its robustness.

Remember that past performance shouldn't be taken as an indicator of future outcomes. The results of backtesting aren't a guarantee of future profits. You should also be aware of fluctuations in the market and transaction costs when using the strategy for live trading. Have a look at the top forex backtester for more tips including software for automated trading, backtesting trading strategies, crypto trading backtester, forex backtest software, backtesting platform, RSI divergence cheat sheet, backtester, software for automated trading, forex backtesting software, divergence trading and more.

What Do You Need To Do To Test The Forex Backtesting Program Trading With Divergence

These are the main factors to be considered when you are evaluating the software for backtesting forex that supports trading using RSI Divergence.

Flexibility: Software needs to be flexible enough to allow customization and testing of various RSI divergence trading strategies.

Metrics: The program must offer a range of metrics to evaluate the performance of RSI diversity trading strategies. These include risk/reward ratios, profitability and drawdown.

Speed: This program must be fast and efficient. It must allow rapid backtesting of various strategies.

User-Friendliness. Even for those who do not have a lot of knowledge in technical analysis The software should be user-friendly.

Cost: Look at the price of the program. Also, think about whether the software is within your financial budget.

Support: Good customer support is required, which includes tutorials as well as technical assistance.

Integration: Software must be compatible with other trading tools like charts software, trading platforms and trading platforms.

To ensure the software meets your needs, and you feel comfortable using it, it is recommended to test it first using an account that is demo. See the top rated position sizing calculator for website recommendations including trading with divergence, forex backtester, forex backtester, automated trading, forex backtesting software, bot for crypto trading, backtesting tool, divergence trading forex, trading platform, crypto trading and more.

How Do Robots For Trading In Cryptocurrency Work In Automated Trade Software?

The robots that trade cryptocurrency operate as an automated trading system by adhering to pre-defined rules and making trades on behalf of the user. This is how it works: Trading Strategy. The user decides on a trading strategy. This covers withdrawal and entry rules including position sizing, risk and management.

Integration: The bot for trading is integrated with the cryptocurrency exchange via APIs, which allows it to access real-time market data and make trades.

Algorithm is a technique which the bot employs to study market data to make decisions based mostly on trading strategies.

Execution - The bot performs trades according to the trading strategy and without manual intervention.

Monitoring: The bot continuously monitors the market and adjusts the trading strategy as required.

The bots that trade in cryptocurrencies are useful in the execution of complex or repetitive trading strategies, decreasing the need for manual intervention, and allowing the user to profit from market opportunities at any time. Automated trading is not without its own set potential risks. This includes the possibility for software mistakes as well as security flaws and loss control of trading decision making. Before you can begin trading live, make sure you thoroughly test and assess the trading bot.