Good Info For Choosing Forex Systems

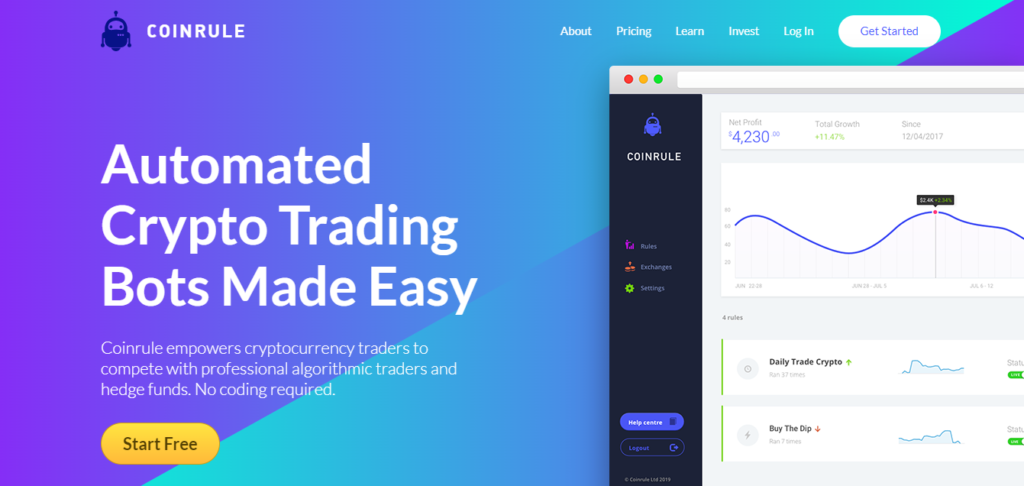

What Exactly Is Automated Cryptocurrency Trading With Regard To Data Analysis?Automated crypto trading refers to the use of algorithms in software to analyze market data, create trading signals, distribute risk, and make trades within the cryptocurrency market.Data Analysis- Automated crypto trading systems analyse large quantities of market data, such as historical price data, trading volumes, news, and other relevant information to help make better trading decisions.

Signal Generation- Based on the analysis of data, the automated trading system generates buy and sell signals, indicating the best moment to start or end a trade.

Risk Allocation- To manage risk and maximise profits, automated crypto trading systems distribute risk by determining the size and setting the stop-loss/take-profit level.

Execution - After the trading signals are established and the risk allocation is established the trading software executes trades, following the pre-defined guidelines.

Automated crypto trading may result in faster efficient, consistent trading than manual methods. Before making use of any cryptocurrency trading system that is automated to trade live, you need to ensure that its reliability and performance is verified. It is important to review and monitor the automated trading system regularly in order to ensure that it continues function properly and meet the expectations of traders. Follow the recommended auto crypto trading bot for site recommendations including best free crypto trading bots, how does trading bots work, auto crypto trading bot, free crypto trading bots, algorithmic trading strategies, backtesting trading, rsi divergence, auto crypto trading bot, trade indicators, free trading bot and more.

What Are The Benefits Of An Automated Trading System?

There are many advantages to automated trading systems, like speed. Automated systems can complete trades more quickly than a human trader. This makes it more efficient and lead to steady results in trading.

Accuracy - Trading platforms that are automated follow a set of rules and guidelines that limit the risk of human error. This can lead to more precise execution of trades and improved trading results.

Consistency- Automated systems can be more reliable than human beings who make impulsive or emotional decisions.

Backtesting: Trading platforms that are automated are able to be tested back by using data from the past to assess their performance and find any issues before they are put into live trading.

Scalability- Automated trading systems can scale to handle large amounts market data and trades that can be difficult for human traders.

24/7 Trading Automated trading systems that can trade 24/7 can increase the chances of profitable trades.

The objective nature of automated trade systems do not have the capability of being influenced by emotions, or any other subjective elements. This reduces the risk of taking impulsive or emotional trades.

Cost-effective- A computerized trading system can be more economical than employing an experienced trader. It could also lower the cost of trading by eliminating the need to make and monitor manually executed trades.

To make sure that an automated trading platform operating properly and is in line with trading objectives, it is essential to test and validate it before deploying it to live trading. To make sure that an automated trading system stays efficient and effective over time, it is crucial to constantly examine and evaluate the performance of the system. Take a look at the most popular online trading platform for site advice including automated cryptocurrency trading, trading platforms, backtesting software forex, best forex trading platform, backtesting in forex, automated software trading, emotional trading, backtester, best crypto indicators, best forex trading platform and more.

What Are The Advantages Of Automated Trading Systems

Inflexibility: Automated systems can be restricted in their ability to adapt to market conditions that change. This can result in low performance in unpredictable market events.

Over-reliance on backtesting - Automated trading platforms are usually tested using data from the past that could not accurately reflect current market conditions. Overly relying on the results of backtesting could result in false security and inadequate performance in live trading.

Lack of knowledge Automated trading needs a lot of knowledge to plan, implement, and monitor. It may not be possible for everyone.

Emotional disconnectment- Automated forex trading systems remove emotional and psychological aspects which are essential in certain kinds of trading. This can result in a lack of creativity and intuition when it comes to trading.

Lack of understanding - Automated trade systems can be confusing and hard to understand. This can make it hard for traders and analysts to recognize and fix issues.

High Initial Investment- Automated trading systems can be expensive to build and implement and require an extensive upfront investment.

Before using automated trading systems in live trading, it is essential to evaluate their benefits and drawbacks. In certain circumstances both automated and manual trading together may be the best route to proceed. It takes full benefit of both methods while minimizing risks. View the best backtesting trading strategies free for site tips including position sizing, crypto backtesting platform, what is algorithmic trading, what is algorithmic trading, position sizing, free crypto trading bot, do crypto trading bots work, best automated crypto trading bot, cryptocurrency automated trading, backtesting in forex and more.

Are Crypto Bots Trading Profitable?

It is dependent on many aspects, such as market conditions, the caliber and risk management practices of traders, and whether crypto bot trading is successful. Although some traders have experienced success trading cryptobots, it does not guarantee profits and is also influenced by the emotions. It is vital to fully examine any bot prior to when it is put into operation. This means examining the past performance and quality code and its risk management methods.

Market conditions can affect crypto bot trading's profitability. Market volatility is one of the main characteristics of cryptocurrency markets. Unexpected price movements can cause significant losses if risk management strategies for the bot are inadequate.

It is also crucial to understand the nuances of the bot's trading strategy that includes how it generates signals, manages risk and performs trades. Traders should also be familiar of the dangers involved in crypto bot trading, including the potential for technical failures, software bugs and market risks.

Conclusion: Although trading cryptobots are profitable, it is not a 100% guarantee. It is crucial to evaluate the bot's performance thoroughly, be aware of the risks, and apply solid methods of managing risk.